Short-Run Production Costs

Paul Scott

7 min read

Listen to this study note

Study Guide Overview

This study guide covers short-run and long-run costs, focusing on the differences between fixed and variable inputs. It explains cost calculations, including fixed costs (FC), variable costs (VC), total costs (TC), and average/marginal costs (AFC, AVC, ATC, MC). The guide also differentiates between accounting and economic costs/profits, emphasizing the importance of implicit costs. Finally, it provides graphs and tables to illustrate cost curve relationships and how shifts in costs impact these curves.

#1. Microeconomics Study Guide: Short-Run Costs and Cost Curves

This unit is absolutely crucial for your AP Micro exam. Make sure you understand these concepts inside and out!

#The Short Run vs. The Long Run

- Short-Run: At least one input is fixed (e.g., factory size). Think of it as a period where you can't easily change everything.

Capital is usually considered fixed in the short run.

- Long-Run: All inputs are variable. Given enough time, you can adjust everything.

The key difference is the flexibility of inputs. Short-run has at least one fixed input, while long-run has all variable inputs.

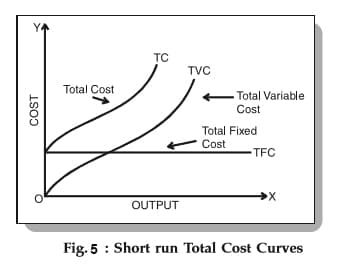

#2. Costs: Fixed, Variable, and Total

- Fixed Costs (FC): Costs that do not change with output (e.g., rent).

These are constant regardless of production level.

- Variable Costs (VC): Costs that do change with output (e.g., raw materials).

These increase as production increases.

- Total Cost (TC): The sum of fixed and variable costs. TC = FC + VC

Remember this equation: TC = FC + VC. It's fundamental!

#Accounting vs. Economic Costs

- Accounting Costs: Explicit, out-of-pocket payments.

- Economic Costs: Sum of explicit costs and implicit costs (opportunity costs).

Always consider opportunity costs in economic analysis.

Forgetting to include implicit costs when calculating economic costs is a common error. Always think about what you're giving up.

Caption: This graph shows that total cost (TC) increases with quantity, while fixed cost (FC) remains constant. Variable cost (VC) is the difference between TC and FC.

#3. Revenue and Profit

- Total Revenue (TR): Price times quantity. TR = P x Q

- Profit: Total revenue minus total cost. Profit = TR - TC

- Accounting Profit: TR - Accounting Costs

- Economic Profit: TR - Economic Costs

Profit is the difference between what you earn (revenue) and what you spend (costs).

#4. Average and Marginal Cost Curves

#Average Costs (Per-Unit Costs)

- Average Total Cost (ATC): Total cost divided by quantity. ATC = TC / Q

- Average Variable Cost (AVC): Variable cost divided by quantity. AVC = VC / Q

- Average Fixed Cost (AFC): Fixed cost divided by quantity. AFC = FC / Q

Remember: ATC = AVC + AFC

#Marginal Cost (MC)

- Marginal Cost: The additional cost of producing one more unit.

Think of it as the cost of the next unit.

- Initially decreases due to specialization, then increases due to diminishing returns.

MC curve is related to the supply curve!

Caption: This graph shows the relationship between AFC, AVC, ATC, and MC. Note that MC intersects AVC and ATC at their minimum points.

#Understanding the Curves

- AFC: Decreases as quantity increases because fixed costs are spread over more units.

- MC: Initially decreases, then increases due to diminishing returns.

- ATC & AVC: Decrease when MC is below them, increase when MC is above them. They hit their minimums when they intersect MC.

Think of the GPA analogy: a grade below your average pulls it down, a grade above pulls it up.

- AVC approaches ATC as quantity increases because AFC approaches zero.

At very high quantities, AFC becomes negligible.

MC intersects both AVC and ATC at their minimum points. This is a crucial relationship to understand.

#5. Example Table and Graphs

Caption: This table shows how fixed, variable, and total costs relate to each other, and how to calculate average and marginal costs.

Caption: This graph shows the relationship between total cost (TC), variable cost (VC), and fixed cost (FC). The vertical distance between TC and VC represents fixed costs.

Caption: This graph shows the typical shapes of the MC, AFC, AVC, and ATC curves. Note the U-shape of AVC and ATC, and how MC intersects them at their minimum points.

Caption: This graph shows how the cost curves shift when variable costs increase. Notice that AFC does not shift, but MC, AVC, and ATC all shift upward.

#6. Final Exam Focus

- Key Concepts: Short-run vs. long-run, fixed vs. variable costs, total cost, average costs (AFC, AVC, ATC), marginal cost, economic vs. accounting costs, profit.

- Curve Relationships: Understand how MC intersects AVC and ATC at their minimum points. Know the shapes of the curves and why they look that way.

- Calculations: Be able to calculate average and marginal costs from a table or graph.

- Shifts: Understand how changes in fixed and variable costs affect the cost curves.

- Common Question Types:

- Graphing cost curves and identifying key points.

- Calculating costs and profits from given data.

- Analyzing the impact of changes in costs on production decisions.

#Last-Minute Tips

- Time Management: Don't spend too long on any one question. If you're stuck, move on and come back later.

- Common Pitfalls: Confusing fixed and variable costs, forgetting implicit costs, misinterpreting the relationship between MC and average costs.

- Strategies: Draw the graphs! Visualizing the curves can help you understand the relationships. Use the GPA analogy to remember how MC affects average costs.

Practice drawing the curves from memory!

Master these cost concepts, and you'll be well-prepared for the exam. You've got this!

Continue your learning journey

How are we doing?

Give us your feedback and let us know how we can improve