The Effects of Government Intervention in Different Market Structures

Rachel Carter

8 min read

Listen to this study note

Study Guide Overview

This study guide covers government intervention in markets, focusing on taxes (per-unit vs. lump-sum) and subsidies, and their impact on costs (MC, ATC, AFC). It also explains monopoly regulation, including the unregulated monopoly graph, socially optimal price, and fair-return price, and how these relate to deadweight loss. Graphing and interpreting these concepts are emphasized. Finally, exam tips for AP Microeconomics are provided.

#AP Microeconomics: Government Intervention & Monopoly Regulation 🚀

Hey there, future AP Micro champ! Let's get you prepped and confident for your exam. We're diving into government intervention and how it impacts firms, especially monopolies. This guide is designed to be your go-to resource for a quick, effective review.

#Government Intervention: Taxes and Subsidies 🏛️

We've seen how markets can fail, and now it's time to explore how the government steps in. The main tools? Taxes and subsidies. Let's break it down:

#

Per-Unit vs. Lump Sum Taxes

Understanding the difference is key:

- Per-Unit Tax: A tax on each unit produced (e.g.,

- Lump Sum Tax: A one-time fixed tax (e.g.,500 flat tax). This affects fixed costs (FC).

The critical distinction: Per-unit taxes shift MC, while lump-sum taxes don't.

#Graphing Taxes: Visualizing the Impact 📈

We'll focus on taxes, but remember, subsidies are just the opposite!

#Per-Unit Taxes

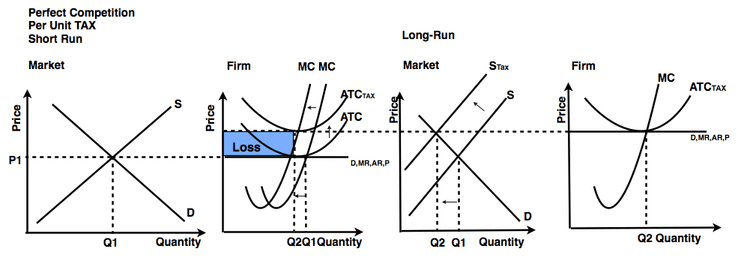

- Impact: Increases marginal cost (MC) and average total cost (ATC).

- Graph: MC and ATC curves shift upward (or to the left).

Think of a per-unit tax as an extra fee for each item you make - it directly adds to the cost of each additional unit.

- Caption: A per-unit tax shifts the MC curve up, leading to a new equilibrium with a lower quantity and higher price. Note the long-run adjustment in a competitive market.

#Lump Sum Taxes

- Impact: Increases average fixed cost (AFC) and average total cost (ATC) but does not affect marginal cost (MC).

- Graph: ATC curve shifts upward.

Imagine a lump sum tax as a one-time fee for doing business - it doesn't change how much it costs to make each additional item, just overall costs.

- Caption: A lump-sum tax shifts the ATC curve up, affecting the firm's profitability but not its marginal cost. Again, note the long-run adjustment.

Practice Question

#Multiple Choice Questions

Question 1: A per-unit tax imposed on a firm in a perfectly competitive market will:

- a) Shift the firm's average total cost curve upward and the marginal cost curve upward.

- b) Shift the firm's average total cost curve upward but not the marginal cost curve.

- c) Shift the firm's marginal cost curve upward but not the average total cost curve.

- d) Shift the firm's average fixed cost curve upward and the marginal cost curve upward. Answer: a

Question 2: Which of the following is true of a lump-sum tax on a firm?

- a) It affects marginal cost and average variable cost.

- b) It affects marginal cost but not average total cost.

- c) It affects average total cost but not marginal cost.

- d) It affects average variable cost but not average total cost. Answer: c

#Free Response Question

Question: Assume a perfectly competitive firm is currently producing at its profit-maximizing output level. The government imposes a per-unit tax on the firm. (a) Using a correctly labeled graph, show the impact of the per-unit tax on the firm's cost curves. (b) Explain how the per-unit tax will affect the firm's profit-maximizing output level and price. (c) Now, suppose instead of a per-unit tax, the government imposes a lump-sum tax. Explain how this will affect the firm's cost curves and profit-maximizing output level.

Scoring:

- Part (a): 1 point for correctly shifting MC and ATC curves upward

- Part (b): 1 point for stating output will decrease; 1 point for stating price will increase

- Part (c): 1 point for stating that only ATC shifts up; 1 point for stating that output will not change

#

Regulating a Monopoly

🎯

Monopolies can lead to market inefficiencies. Let's see how the government can step in.

#The Monopoly Graph

Here's a reminder of the classic monopoly setup:

-

Caption: This graph shows the monopolist's output (Qm) and price (Pm) where MR=MC. Notice the deadweight loss.

-

Unregulated Monopoly: Produces at point M, where MR = MC, leading to deadweight loss.

#Government Intervention Options

We aim to move closer to the socially optimal point (where P = MC).

#Socially Optimal Point

- Goal: Set a price ceiling at P2 to force the monopoly to produce at Q3, where P = MC.

- Challenge: The firm incurs a loss and needs a lump-sum subsidy to operate.

#Fair-Return Point

- Goal: Allow the monopoly to produce at point B, where it breaks even (P3, Q2).

- Pros: No subsidy needed; reduces deadweight loss compared to the unregulated monopoly.

- Cons: Some deadweight loss remains.

The socially optimal point maximizes social welfare but requires subsidies. The fair-return point is a compromise that avoids subsidies but allows some deadweight loss.

Don't confuse the socially optimal point with the profit-maximizing point for a monopoly. They are different!

Think of the socially optimal point as the ideal, but the fair-return point as the realistic compromise.

Practice Question

MCQ

-

Question: If a government regulates a natural monopoly by setting a price ceiling at the socially optimal price, which of the following is most likely to occur?

- a) The monopoly will earn positive economic profits.

- b) The monopoly will incur an economic loss.

- c) The monopoly will produce at the allocatively efficient level of output.

- d) The monopoly will produce where marginal revenue equals marginal cost. Answer: b

-

Question: A fair-return price for a regulated monopoly is a price that is equal to:

- a) marginal cost.

- b) average total cost.

- c) average variable cost.

- d) marginal revenue. Answer: b

FRQ

Question: Assume a natural monopoly is currently unregulated. (a) Draw a correctly labeled graph showing the monopoly's demand, marginal revenue, marginal cost, and average total cost curves. Indicate the profit-maximizing output and price. (b) On the same graph, show the socially optimal output and price. Explain why this is considered the socially optimal level. (c) Explain why a government might choose to regulate the monopoly at the fair-return price instead of the socially optimal price.

Scoring:

- part_a: 1 point for correctly labeled axes and curves; 1 point for showing the profit-maximizing output and price where MR=MC

- part_b: 1 point for correctly showing the socially optimal point where P=MC; 1 point for explaining that this is where allocative efficiency is achieved

- part_c: 1 point for explaining that the fair-return price allows the firm to break even and avoids the need for subsidies

#Final Exam Focus 🎯

Alright, here's what to prioritize for the exam:

- High-Value Topics: Government intervention (taxes/subsidies) and monopoly regulation. These are frequently tested!

- Key Concepts: Per-unit vs. lump sum taxes, socially optimal vs. fair-return price, deadweight loss.

- Graphing: Be comfortable drawing and interpreting graphs related to taxes, subsidies, and monopolies.

Practice drawing these graphs from scratch. It's the best way to solidify your understanding.

#Last-Minute Tips

- Time Management: Don't spend too long on any one question. Move on and come back if needed.

- Common Pitfalls: Watch out for tricky wording in questions. Read carefully!

- FRQ Strategies: Plan your answers before writing. Use clear, concise language and label all parts of your graphs.

Remember that per-unit taxes affect MC, while lump-sum taxes affect ATC. This distinction is crucial!

You've got this! Stay calm, trust your preparation, and go ace that exam! 🌟

Continue your learning journey

How are we doing?

Give us your feedback and let us know how we can improve