Externalities

Rachel Carter

8 min read

Listen to this study note

Study Guide Overview

This study guide covers externalities in microeconomics, including negative externalities (e.g., pollution) and positive externalities (e.g., vaccinations). It explains marginal social cost (MSC), marginal private cost (MPC), marginal social benefit (MSB), and marginal private benefit (MPB). It also discusses how Pigouvian taxes and subsidies can address externalities and includes graph analysis, practice questions, and exam tips.

#AP Microeconomics: Externalities - Your Last-Minute Guide

Hey there, future econ whiz! Let's break down externalities in a way that's easy to remember and super helpful for your exam. Think of this as your secret weapon for acing those tricky questions. Let's get started! 🚀

#

What are Externalities?

An externality is like a side effect of an economic decision that affects someone who wasn't part of the original choice. It's a third-party impact, and it can be either good or bad.

- Key Idea: It's about costs or benefits that spill over to others.

#Types of Externalities

-

Negative Externality: 😠

- This is when an economic activity creates costs for others. Think of pollution from a factory.

- Marginal Social Cost (MSC) > Marginal Private Cost (MPC)

- The market overproduces because firms don't consider the full social cost.

-

Positive Externality: 😊

- This is when an economic activity creates benefits for others. Think of getting a vaccine.

- Marginal Social Benefit (MSB) > Marginal Private Benefit (MPB)

- The market underproduces because consumers don't consider the full social benefit.

Think of it this way:

- Negative = Nasty (costs to others)

- Positive = Pleasant (benefits to others)

#

Negative Externalities: The Nitty-Gritty

#Examples

- Pollution: Factories releasing pollutants into the air or water. 🏭

- Secondhand Smoke: Affecting the health of those nearby. 🚬

#The Graph

- MPC (Marginal Private Cost): The cost to the firm of producing one more unit.

- MSC (Marginal Social Cost): The total cost to society of producing one more unit (including external costs).

- MSB (Marginal Social Benefit): The benefit to society of consuming one more unit.

- Free Market Quantity (QFM): Where MPC = MSB (point A).

- Socially Optimal Quantity (QSO): Where MSC = MSB (point B).

- Deadweight Loss (DWL): The area ABC, representing the inefficiency of the free market.

Key takeaway: In a negative externality, the market produces too much.

#How to Fix It: Per-Unit Tax

- The government imposes a per-unit tax to make the firm internalize the external costs.

- This shifts the MPC curve leftward to the MSC curve.

- The goal is to reduce production to the socially optimal quantity.

#

Positive Externalities: The Bright Side

#Examples

- Vaccinations: Protecting not only yourself but also others. 💉

- Education: Leading to a more informed and productive society. 👨🏽🏫

#The Graph

- MPB (Marginal Private Benefit): The benefit to the consumer of consuming one more unit.

- MSB (Marginal Social Benefit): The total benefit to society of consuming one more unit (including external benefits).

- Free Market Quantity (QFM): Where MPB = MSC (point A).

- Socially Optimal Quantity (QSO): Where MSB = MSC (point B).

- Deadweight Loss (DWL): The area ABC, representing the inefficiency of the free market.

Key takeaway: In a positive externality, the market produces too little.

#How to Fix It: Per-Unit Subsidy

- The government provides a per-unit subsidy to encourage consumption.

- This shifts the MPB curve rightward to the MSB curve.

- The goal is to increase production to the socially optimal quantity.

#

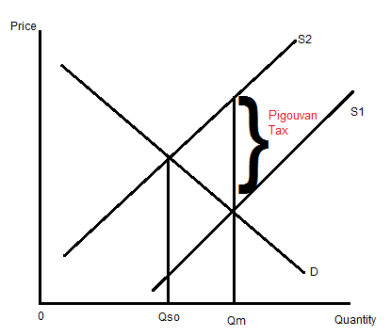

Pigouvian Taxes and Subsidies: The Government's Toolkit

- Pigouvian Taxes: Taxes on goods with negative externalities.

- They shift the supply curve to the left, reducing output.

- Pigouvian Subsidies: Subsidies on goods with positive externalities.

- They shift the demand curve to the right, increasing output.

Remember:

- Tax = Take Away (reduces production for negative externalities)

- Subsidy = Support (increases production for positive externalities)

#Negative Externality and Per-Unit Tax

- The tax is equal to the vertical distance between MPC and MSC.

- Shifts the MPC curve up and to the left until it equals MSC.

#Positive Externality and Per-Unit Subsidy

- The subsidy shifts the MPB curve down and to the right.

- Increases production to the socially optimal quantity.

#

Example Question: AP Micro 2017 Question 3

#Question Breakdown

- a) Monopolist's profit maximizing price and quantity:

- Where MR = MPC, which is Q3 and P4. * b) Indication of a negative externality:

- MSC > MPC, meaning social costs are higher than private costs.

- c) Socially optimal quantity:

- Where MSC = MSB, which is at Q2. * d) Per-unit tax:

- i) Dollar value of the tax: P4 - P1 (the vertical distance between MPC and MSC).

- ii) Profit-maximizing quantity after tax: Q2 (where the new MPC = MSC = MSB).

- e) Change in deadweight loss:

- Deadweight loss increases because the tax forces the market to underproduce relative to the socially optimal quantity.

Common Mistake: Forgetting that a tax on a monopoly with a negative externality can actually increase deadweight loss, because it will cause the firm to underproduce even more than it was already doing.

#

Final Exam Focus

#Key Areas to Master

- Distinguishing between MPC, MSC, MPB, and MSB.

- Graphing externalities correctly.

- Understanding the impact of per-unit taxes and subsidies.

- Identifying deadweight loss.

- Connecting externalities to market failure and government intervention.

#Common Question Types

- Multiple Choice Questions: Identifying types of externalities, interpreting graphs, and understanding policy implications.

- Free Response Questions (FRQs): Drawing and explaining graphs, calculating the size of taxes and subsidies, and analyzing the effects of government intervention.

#Last-Minute Tips

- Time Management: Quickly identify the type of externality and draw the relevant graph.

- Common Pitfalls: Confusing private and social costs/benefits, misinterpreting the socially optimal quantity.

- Strategies for FRQs: Clearly label all curves and points, explain your reasoning step-by-step, and use economic vocabulary.

Exam Tip: Always start by drawing the graph. It will help you visualize the problem and avoid mistakes.

#

Practice Question

Practice Questions

#Multiple Choice Questions

-

Which of the following is the best example of a good with a positive externality? (A) Cigarettes (B) A loud concert in a residential area (C) Flu vaccinations (D) A factory polluting a river (E) Fast food

-

A negative externality exists when: (A) Marginal social benefit is greater than marginal private benefit. (B) Marginal social cost is greater than marginal private cost. (C) Marginal private cost is greater than marginal social cost. (D) Marginal private benefit is greater than marginal social benefit. (E) There is no deadweight loss.

-

If the government imposes a per-unit tax on a good with a negative externality, the tax will: (A) Increase the quantity produced. (B) Decrease the quantity produced. (C) Have no effect on the quantity produced. (D) Increase the deadweight loss. (E) Shift the demand curve to the right.

#Free Response Question

Consider a market for gasoline, which produces a negative externality due to pollution. The marginal private cost (MPC) of producing gasoline is given by the equation MPC = 2Q, where Q is the quantity of gasoline in gallons. The marginal social cost (MSC) is given by the equation MSC = 3Q. The marginal social benefit (MSB) is given by the equation MSB = 12 - Q.

(a) Draw a correctly labeled graph showing the MPC, MSC, and MSB curves. Identify the free market equilibrium quantity and the socially optimal quantity.

(b) Calculate the free market equilibrium quantity and price.

(c) Calculate the socially optimal quantity and price.

(d) Calculate the per-unit tax that would achieve the socially optimal quantity.

(e) Calculate the deadweight loss at the free market equilibrium.

#FRQ Scoring Breakdown

(a) Graph (4 points)

- 1 point for correctly labeling the axes (Quantity and Price).

- 1 point for correctly graphing the MPC curve.

- 1 point for correctly graphing the MSC curve above the MPC curve.

- 1 point for correctly graphing the MSB curve intersecting both MPC and MSC.

(b) Free Market Equilibrium (2 points)

-

1 point for setting MPC = MSB (2Q = 12 - Q).

-

1 point for correctly solving for Q = 4 and P = 8. (c) Socially Optimal Quantity (2 points)

-

1 point for setting MSC = MSB (3Q = 12 - Q).

-

1 point for correctly solving for Q = 3 and P = 9. (d) Per-Unit Tax (2 points)

-

1 point for recognizing the tax should be the difference between MSC and MPC at the socially optimal quantity.

-

1 point for calculating the tax as $3 (3Q - 2Q = Q = 3 at Q=3, so tax per unit is 3).

(e) Deadweight Loss (2 points)

- 1 point for recognizing the deadweight loss triangle is between the free market and socially optimal quantities.

- 1 point for correctly calculating the area of the triangle: 0.5 * (4-3) * (9-6) = 1.5

Remember, you've got this! You're well-prepared, and you're going to rock this exam. Go get 'em! 💪

Continue your learning journey

How are we doing?

Give us your feedback and let us know how we can improve